Why Financial Services Organizations Need a Global AV Partner

Customer expectations are at an all-time high at a time when the digital realm has provided consumers have significantly more choices and added control. As a result, consumers are actively seeking experiences as well as the ability to build solid relationships.

While this is the new reality within most industries, it is front and center for those within financial services. After all, few industries have as much customer data as those within financial services.

How people define financial services has evolved in recent years. The financial services segment spans a wide array of companies including diversified global firms offering retail banking, capital markets, and insurance. Likewise, financial technology and payment providers, insurance companies, mutual fund companies, stock brokerages, credit cards, consumer finance companies and credit unions are all part of the mix.

As this dynamic mix of organizations jockey for position in today’s environment, there are many areas where embracing the right audiovisual (AV) technology and global partner can play a pivotal role.

Drive digital innovation

Digital isn’t just here, it is compounding. It is empowering employees, partners and customers to collaborate on new processes, develop new solutions and accelerate speed to market to increase competitive advantage.

There are various technologies taking center stage for financial services organizations as digital marketplace grows including blockchain, cloud-based services, digital marketing, digital banking, P2P lending, smart contracts, robo-advice and open banking.

Having the right technology partner can help financial services companies embed continuous innovation in their culture and organization design to drive ongoing business value and move faster than competitors. Properly equipping innovation centers with AV technology is a prime example. Innovation centers need a mix of displays and tools designed to work through ideas such as electronic whiteboards.

Adding AV equipment to the mix cannot be an afterthought. Having proper acoustics, lighting and environmental controls are key components to getting the most out of these technologies. Additionally, having the ability to bring up and predominately display research – without interrupting the collaborative flow as the team is brainstorming – is significant and often requires access to network bandwidth.

Improve organizational agility

Agility is a key part of being able to meet constantly evolving customer expectations. As a global AV provider, Electrosonic has an innate ability to supporting financial services firms as they transform their business models and services with technology, by helping strategically select the tools needed to provide real-time enterprise visibility; reduce business, technology, operational, and cyber risks; and decrease costs.

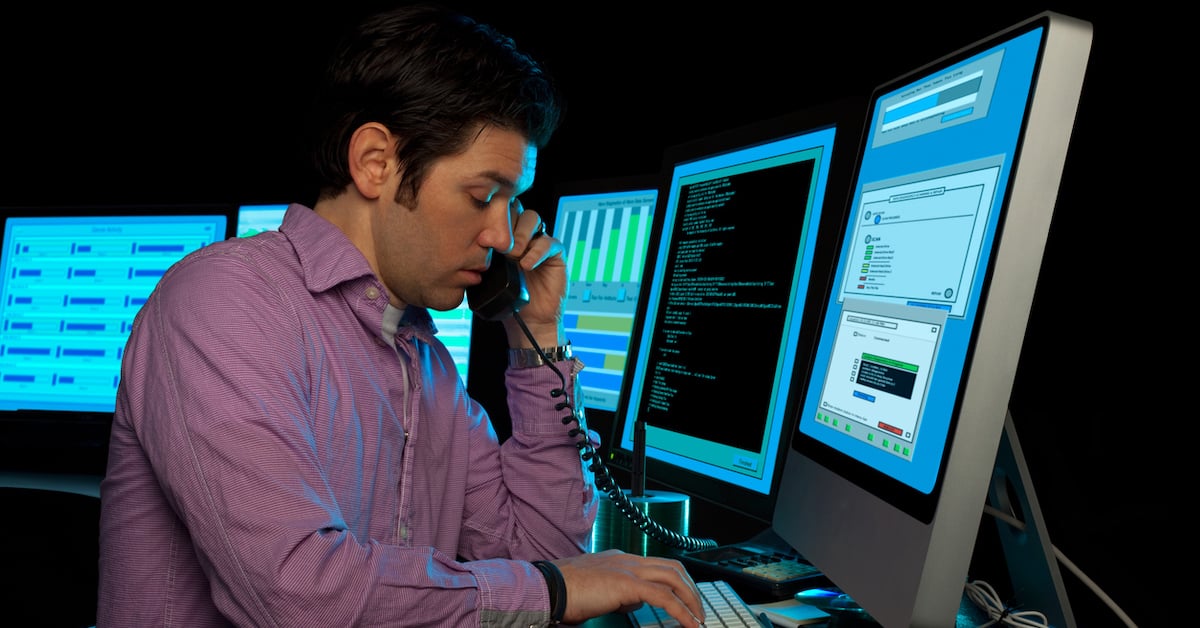

This industry is also the most targeted of industries. For instance, while the average US business is attacked 4M times a year, the average US financial services firm is attacked a billion times a year. Such cyberattacks cost financial service organizations $18M to address vs $12M for other firms. Having highly connected command centers can prove pivotal in enabling the organizational agility needed to stay abreast of developments and make the most of technologies focused on fighting off attacks.

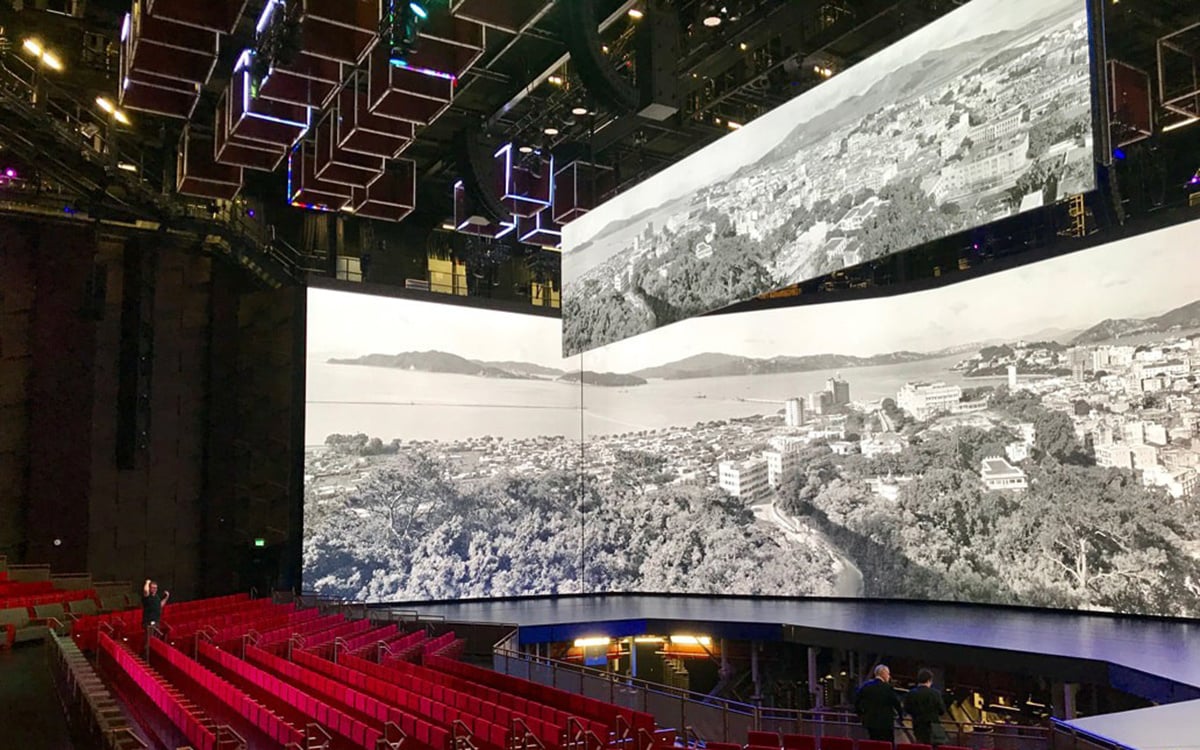

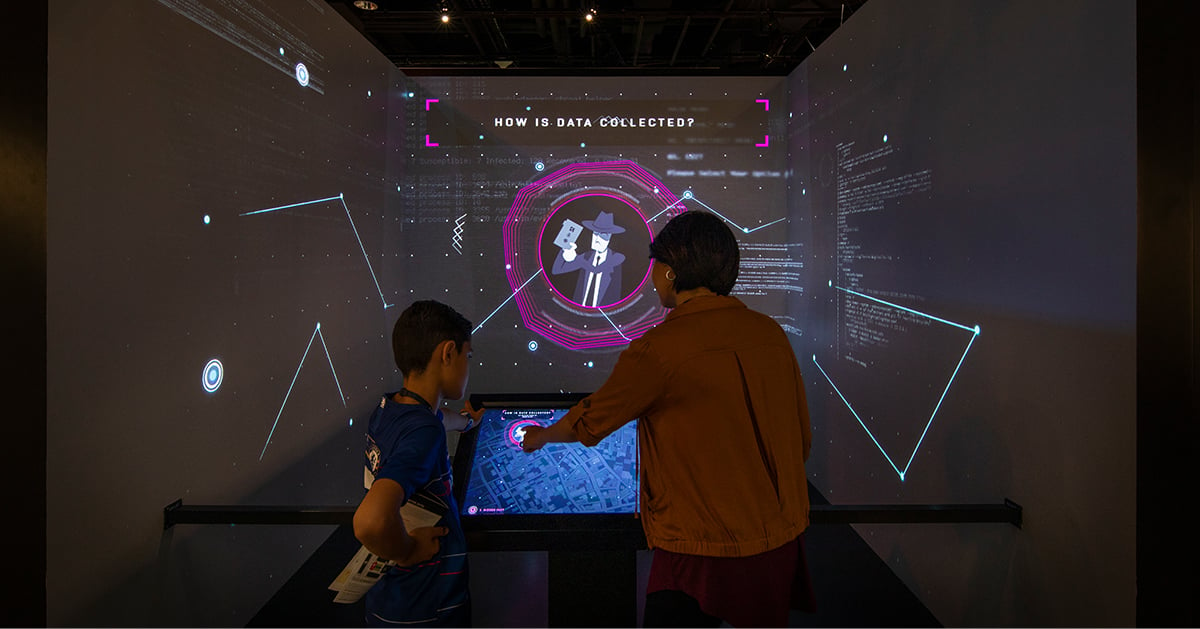

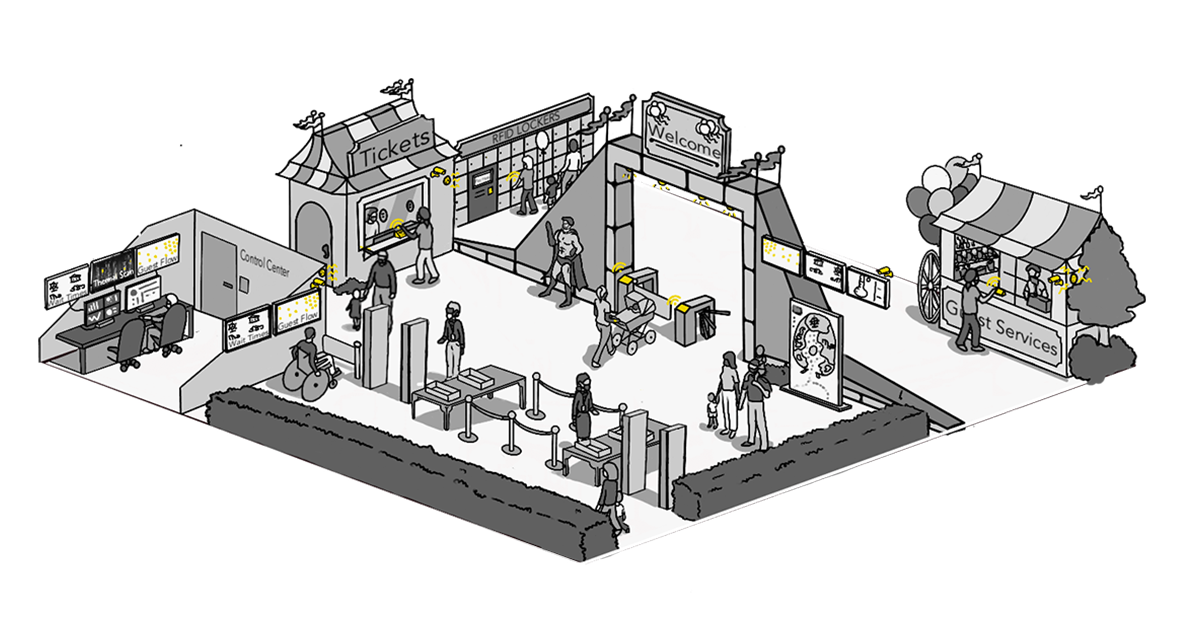

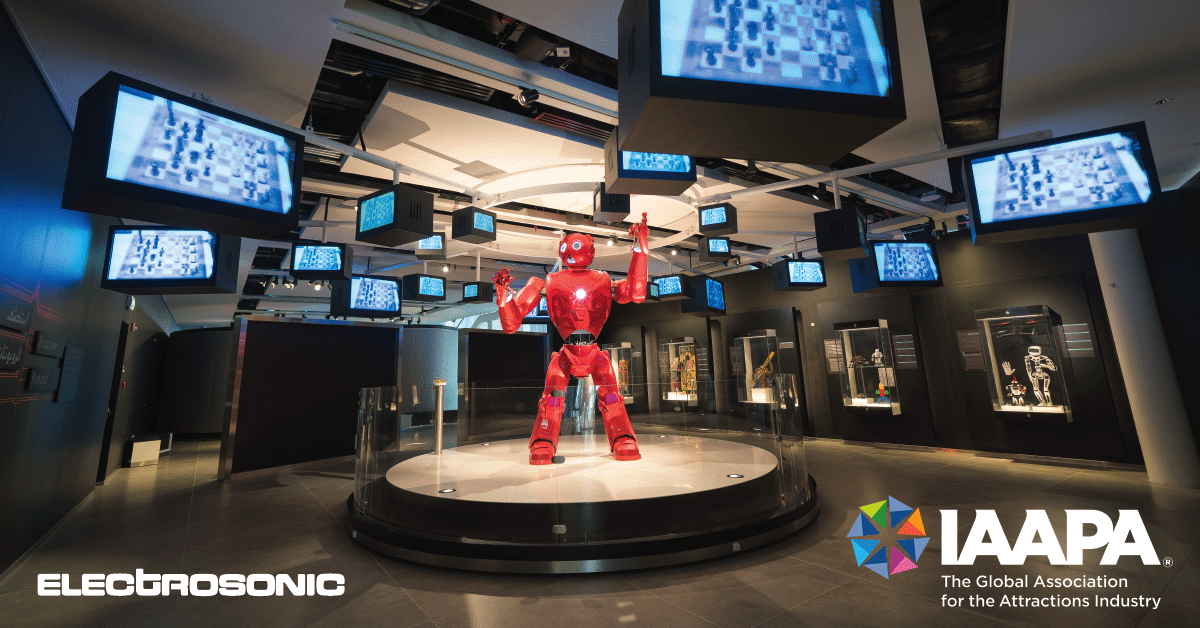

AV technologies like dynamic video walls are often important components. Video walls and their associated software provide a highly customizable, readily accessible information dashboard for real-time monitoring and response by multiple simultaneous users. They enable operators to view, share and control all essential operational information in a single image space instead of switching workstations. Operators can display content from any source in any format for different scenarios and create templates to speed presentation for recurring or critical scenarios.

Accelerate customer engagement

Succeeding within the experience economy means financial service organizations need to shift focus away from bundles. Today’s customer has a desire to unbunde and splinter services such as banking, 401K, investments, lending and payments. Keeping this mix in house relies heavily on engagement. When financial service organizations effectively engage with customers, it drives revenues by building a brand for customer-centricity.

Strategically leveraging innovative technology solutions can also drive productivity and collaboration, increase personalization, while also deepening and expanding existing relationships.

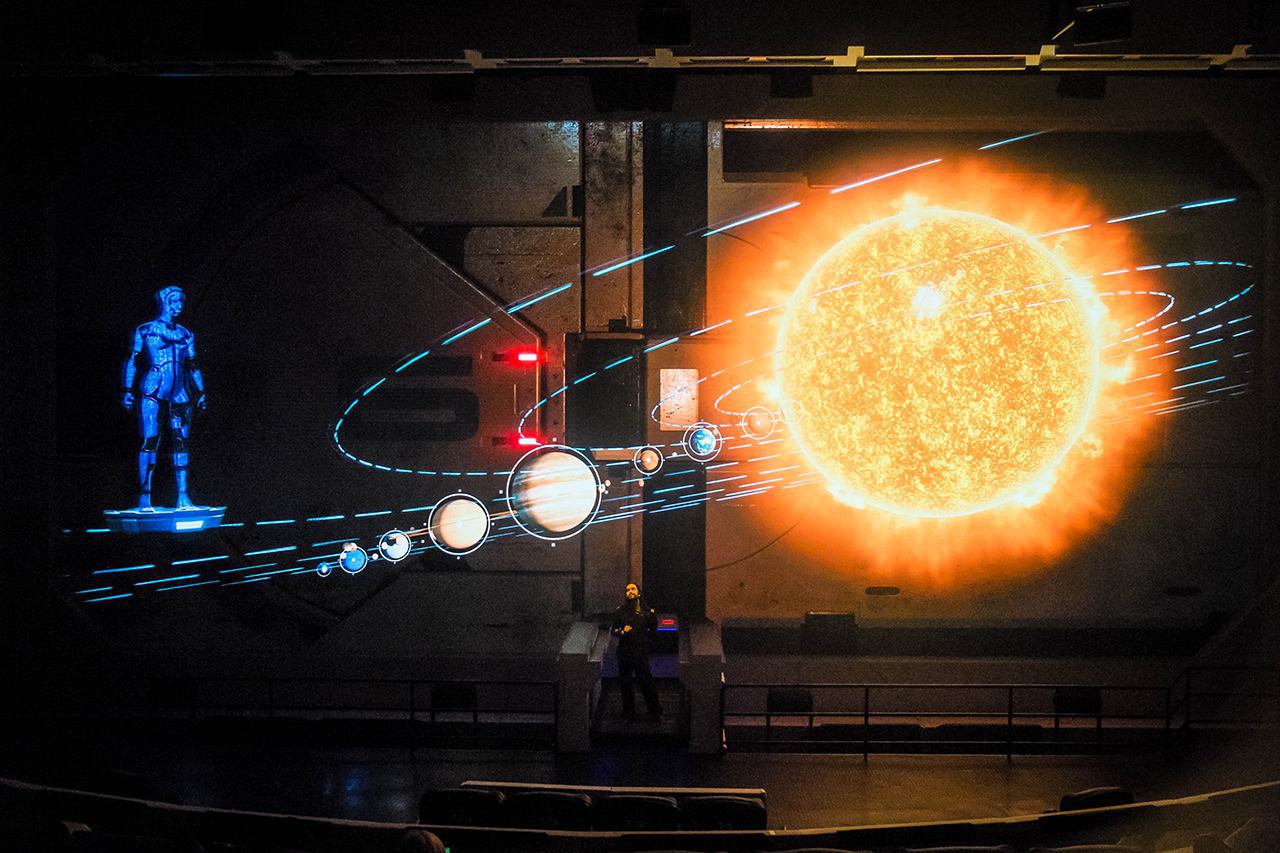

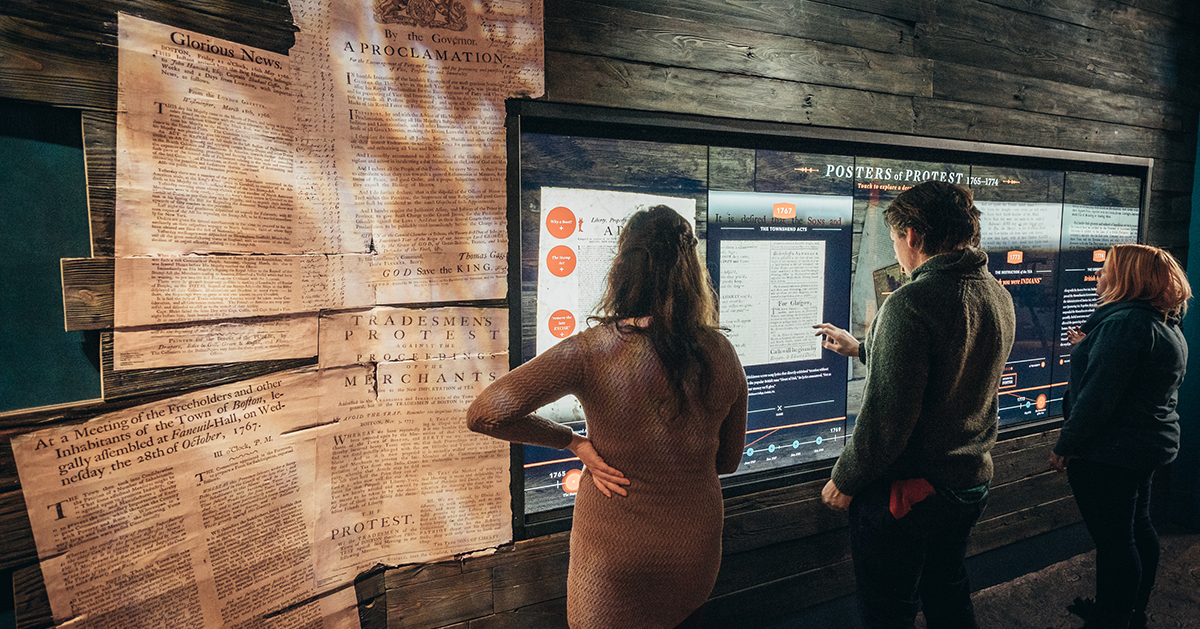

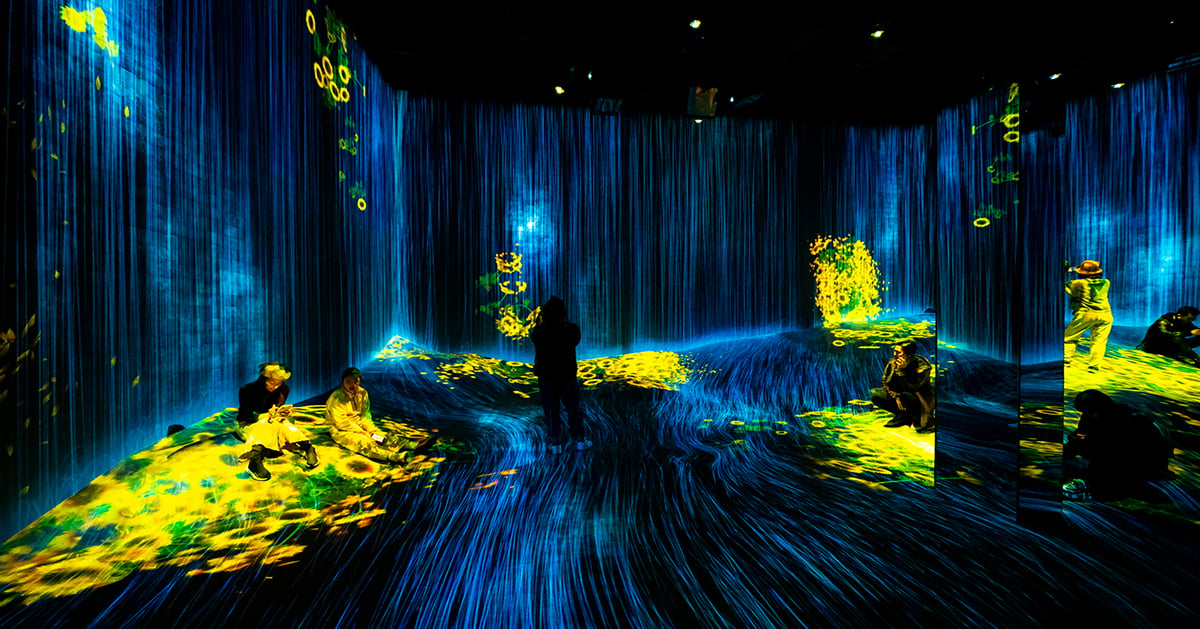

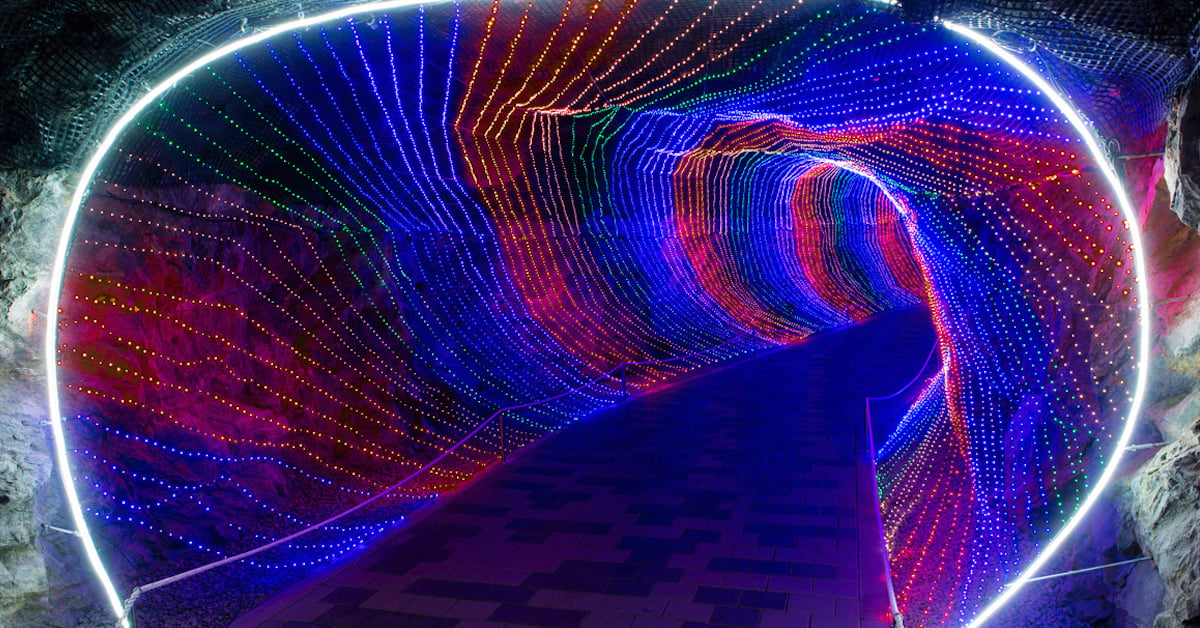

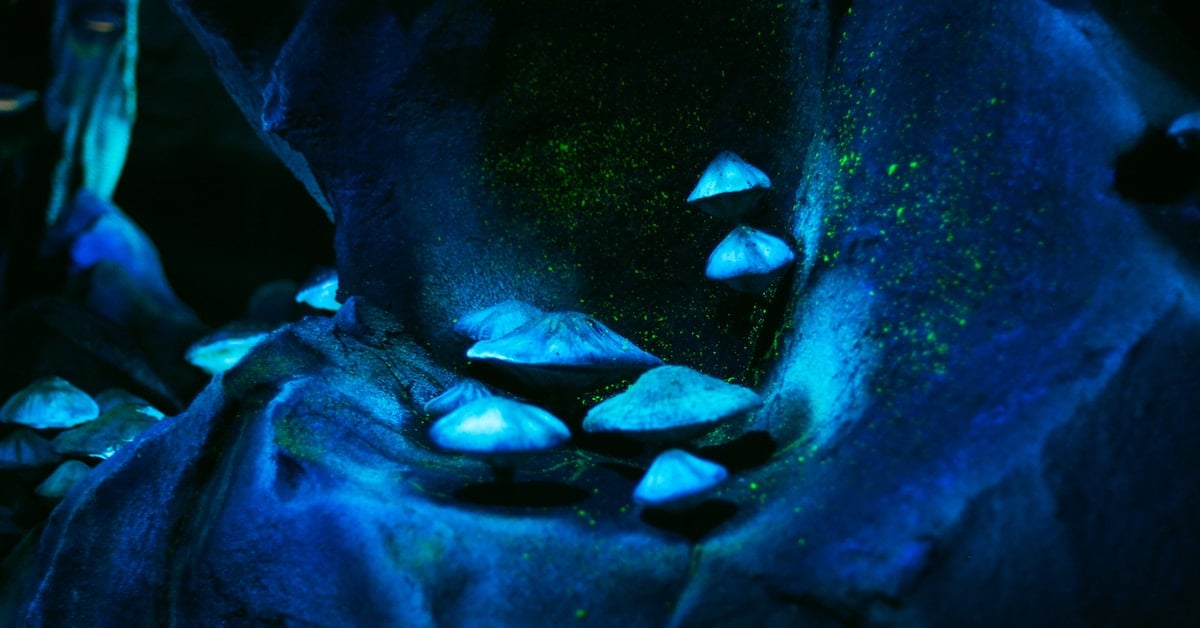

Rethinking physical spaces, including bank branches to deliver an experience that increases customer traffic and enables face-to-face interactions for greater value is crucial with the new tech savvy consumer. Drawing from the approaches utilized in successful executive briefing centers can play a key role here. The key to a successful briefing center is the ability to provide guests with an immersive environment, which often means providing a mix of interactive technologies capable of delivering a highly customized experience. Effectively selecting the proper technology starts with accepting that a true design led approach spends time upfront understanding the goals, the type of content involved and each individual aspect of the application. You never want to find yourself in a position where a technology deployment is taking center stage over your brand story or your ability to interact with the guest.

Interested in learning more about how working with a global AV partner like Electrosonic can play a pivotal role in helping your organization navigate the changing expectations? With over 55 years of experience empowering customers to make the most of technology deployments, Electrosonic has the expertise you need to succeed. Click here to learn more.

Maurizio Capuzzo

Maurizio Capuzzo, Electrosonic’s Chief Marketing Officer, fuses the science of data with the art of visual and verbal communication to explain how technology adds value and helps foster innovation. Maurizio writes from a wealth of experience, holding leadership roles in global technology companies as well as possessing a deep understanding of how technology contributes to business growth.

.jpg?width=1500&height=995&name=ELC501_N17_medium%20(1).jpg)